In a recent statement, Reserve Bank of India( RBI) Governor, Shaktikanta Das, exfoliate light on the ongoing disinflation process in the country. In this composition, we will claw into the conception of disinflation and bandy the crucial factors affecting its slow progress as stressed by Governor Das.

Disinflation

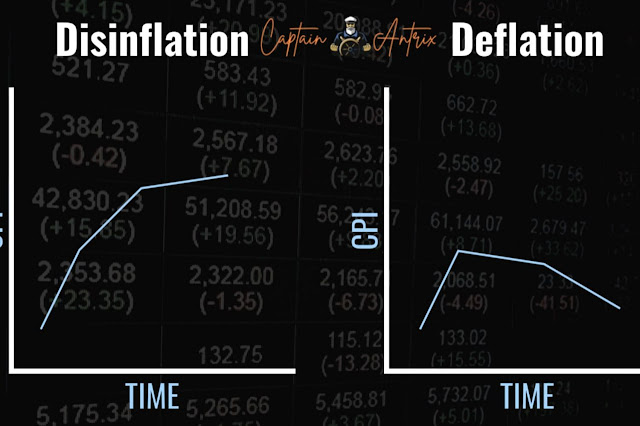

Disinflation refers to a drop in the rate of affectation, i.e., a decline in the general price position of goods and services over time. It's important to note that disinflation is distinct from deflation, which signifies a sustained drop in prices. Disinflation, on the other hand, indicates a reduction in the affectation rate but still involves a positive affectation position.

Slow Disinflation Process

Governor Shaktikanta Das conceded that the disinflation process in India has been progressing at a slow pace. He stressed several factors contributing to this promptness and emphasized the need for a holistic approach to attack these challenges effectively.

1. Supply-Side Constraints:

One of the major reasons for the slow disinflation process is the patient force- side constraints. Issues similar as transportation backups, dislocations in the force chain, and rising input costs have hampered the smooth functioning of diligence. These factors have led to increased product costs, limiting the compass for price reductions.

2. Global Commodity Prices:

The impact of global commodity prices on the domestic frugality can not be overlooked. oscillations in prices of essential goods like crude oil painting, essence, and food particulars directly impact affectation rates. Governor Das refocused out that the high volatility in global commodity prices has posed challenges for achieving a briskly disinflation process.

3. Structural Factors:

Governor Das emphasized the presence of structural factors that have hindered the pace of disinflation. These factors include rigor in the labor request, inefficiencies in the agrarian sector, and infrastructural backups. Addressing these structural issues requires comprehensive policy reforms and long- term measures.

4. Inflation Expectations:

Affectation prospects play a pivotal part in shaping factual inflation. However, they tend to acclimate their gest consequently, leading to patient inflationary pressures, If homes and businesses anticipate advanced affectation in the future. Governor Das stressed the need to anchor affectation prospects through believable and transparent financial policy fabrics.

Way Forward

To expedite the disinflation process, Governor Das proposed a multi-pronged strategy that combines structural reforms, visionary force- side operation, and effective communication. He emphasized the significance of enhancing productivity, perfecting the ease of doing business, and boosting investments in structure. also, Governor Das stressed the need for near collaboration between financial policy and financial policy to support disinflationary objects.

The disinflation process in India, as stressed by RBI Governor Shaktikanta Das, has been progressing sluggishly due to colorful factors. force- side constraints, global commodity price oscillations, structural issues, and affectation prospects have all contributed to the sluggish pace of disinflation. To overcome these challenges, a comprehensive approach involving structural reforms and coordinated policy measures is needed. By addressing these issues, India can pave the way for a sustained and stable disinflationary terrain, fostering profitable growth and stability.